The EDCI has several value propositions for General Partners

The ESG Data Convergence Initiative has a number of functions that are specifically tailored for all GPs

Streamlined Data Collection

Simplify reporting processes, saving time and resources for both GPs and portfolio companies

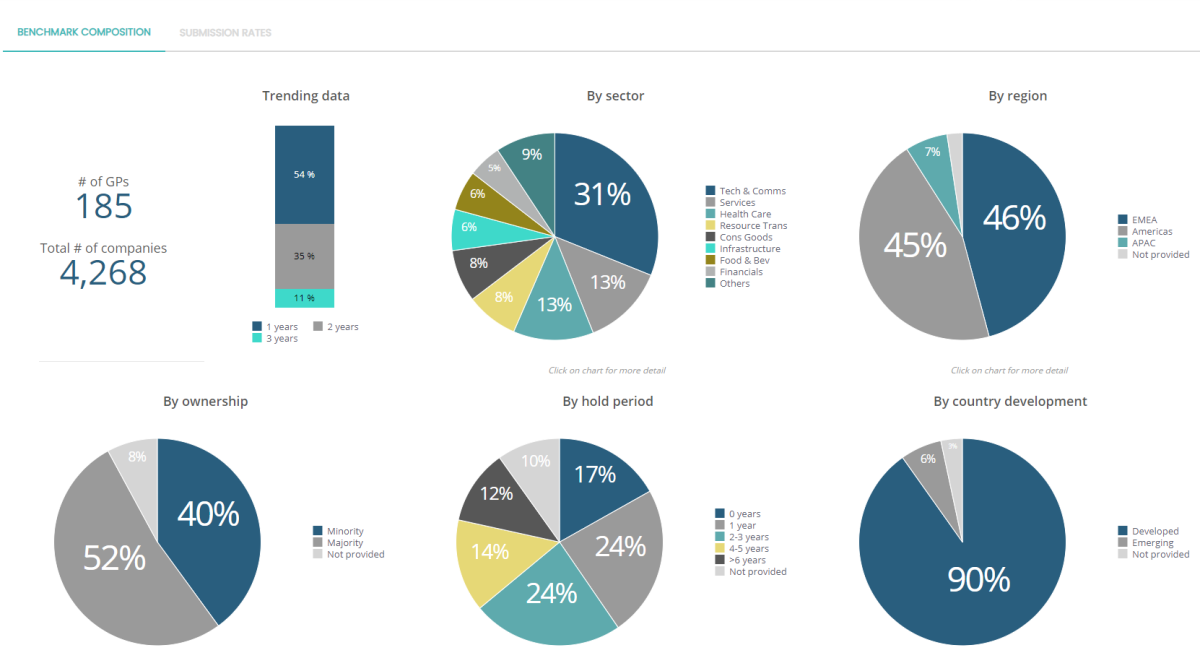

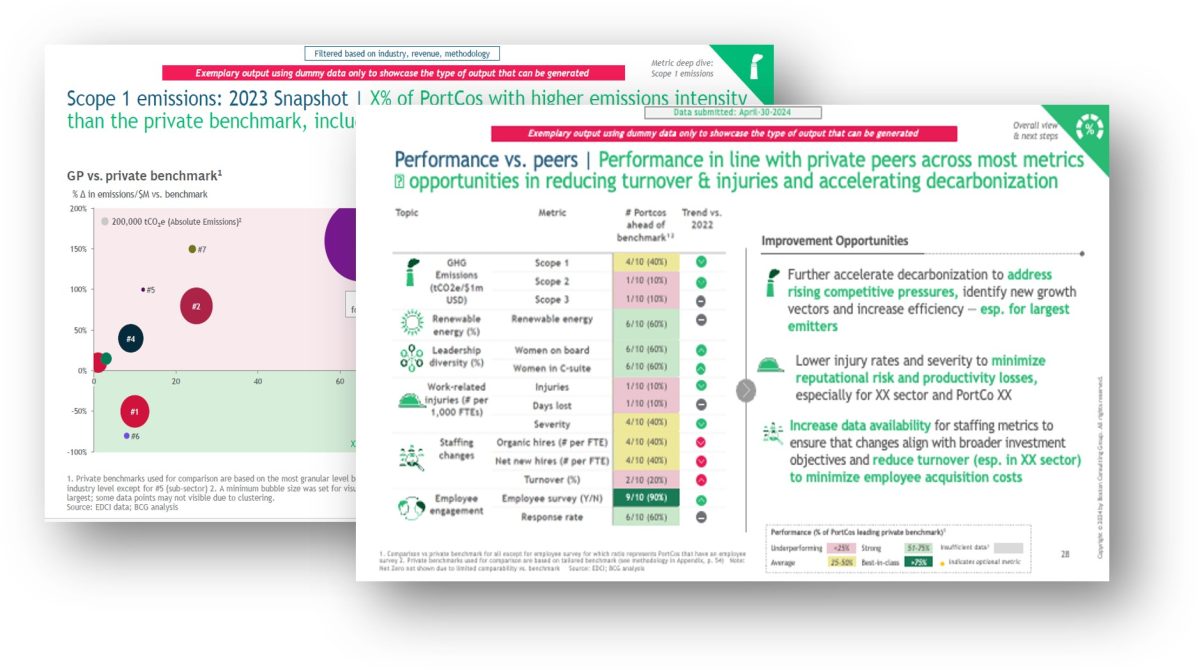

Clarity on ESG Performance

Gain clear insights into ESG performance of portfolio companies relative to peers while pinpointing strengths and areas for ESG improvements – includes nuanced classification for granular benchmarking

Simplified Data Sharing

Manage and streamline transmission of ESG data between GPs and LPs to share portfolio company data directly through the EDCI platform

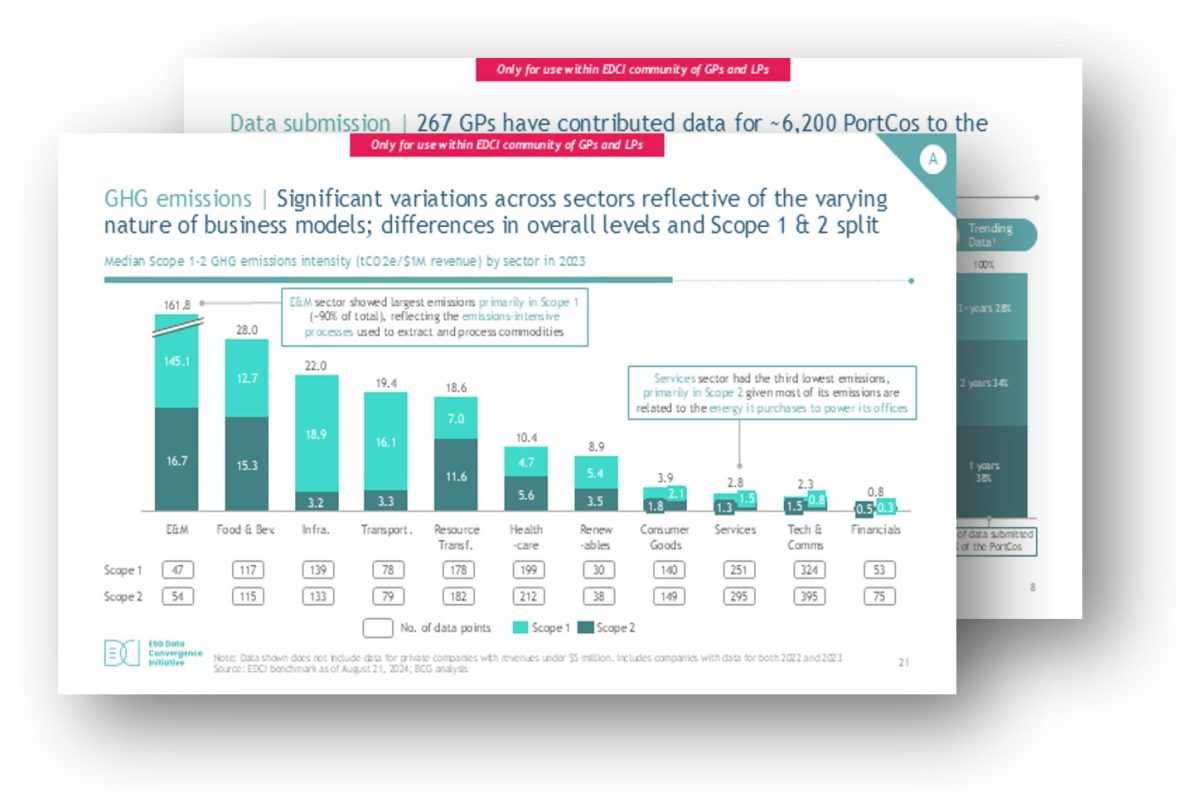

Informed Investments

Add an analytical lens for making well-informed decisions about future investments

Financial Correlation

Uncover the correlation between ESG efforts and financial performance, guiding strategic investment choices

Financial Sustainability

From its inception, the EDCI has been made possible by many hundreds of people doing additional work off the sides of their desks, alongside the full time pro bono support provided by BCG. To ensure the Initiative is well positioned to sustain its current momentum, the Steering Committee has spent considerable time working with BCG to develop a plan to build financial sustainability for the EDCI over time, so it is not perpetually reliant on ongoing pro bono contributions.

Firstly, all GPs and LPs will be able to continue to participate in the EDCI free of charge for the foreseeable future, and in doing so access the high-quality benchmark offering available to participants in the inaugural year of the initiative (i.e. 2022). To ensure the Initiative can continue to serve the industry over the long term, the Steering Committee have developed a plan to build financial sustainability.

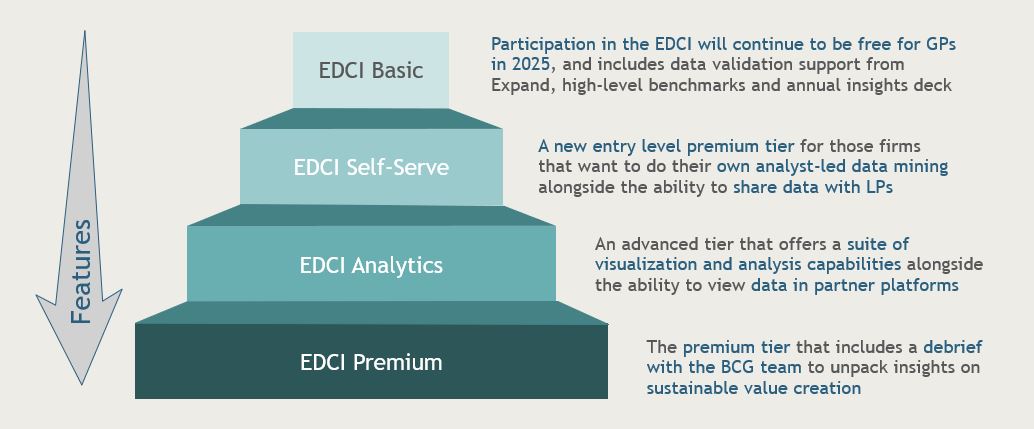

All EDCI GPs are now able to choose to become a premium EDCI member and self-select which premium tier enables the most value for their organization.

EDCI GP membership tiers for the 2025 Benchmark Year

GP Membership Features & Functionalities | EDCI Basic

GP Membership Features & Functionalities | EDCI Self-Serve

GP Membership Features & Functionalities | EDCI Analytics

GP Membership Features & Functionalities | EDCI Premium

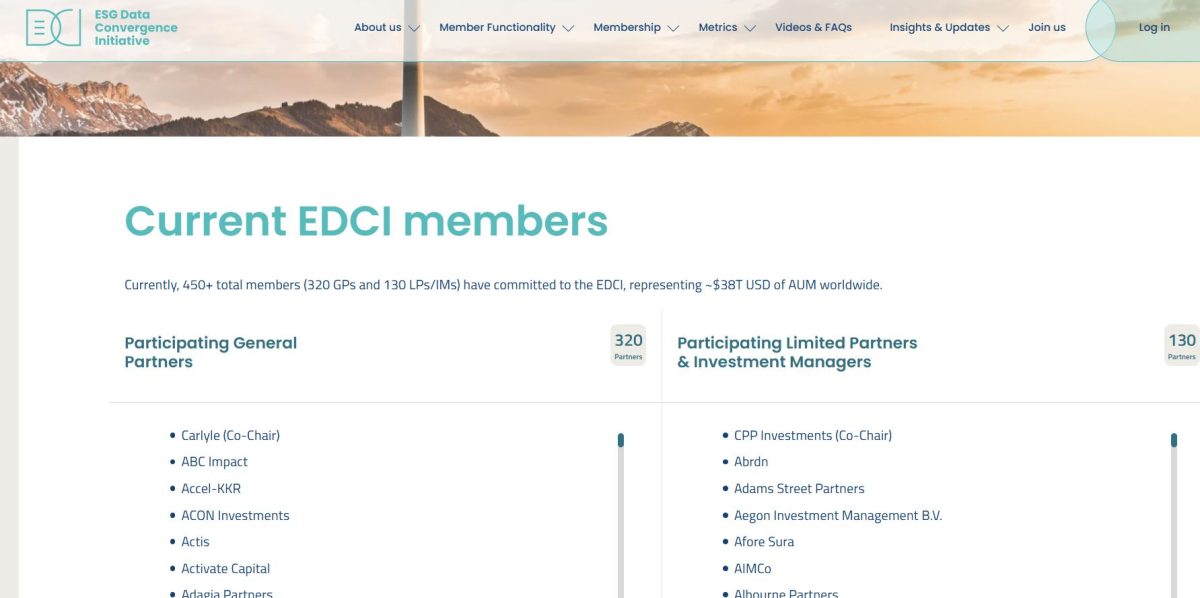

What does it mean for General Partners to be part of this initiative?

To participate, GPs agree to:

- Determine funds that will take part in the initiative (while we recognize GPs may start with a subset of their investment strategies, the expectation is this will increase over time, as feasible)

- On a best-efforts basis, track EDCI metrics, with an emphasis on core metrics

- Abide by the EDCI Metrics Guidance to the extent possible and explain deviations

- As requested, provide EDCI data to LPs, preferably using the data sharing functionality on the EDCI portal, or related template

- Submit data to the EDCI for participating portfolio companies by April 30 each year

- Be publicly associated with the initiative

- Voluntary: serve on working groups or self-nominate to join the Steering Committee