The EDCI has several value propositions for LPs

The ESG Data Convergence Initiative has a number of functions that are specifically tailored for LPs

01

Streamline Reporting

Simplify reporting processes by converging around the definition of key ESG metrics

02

Increased Transparency

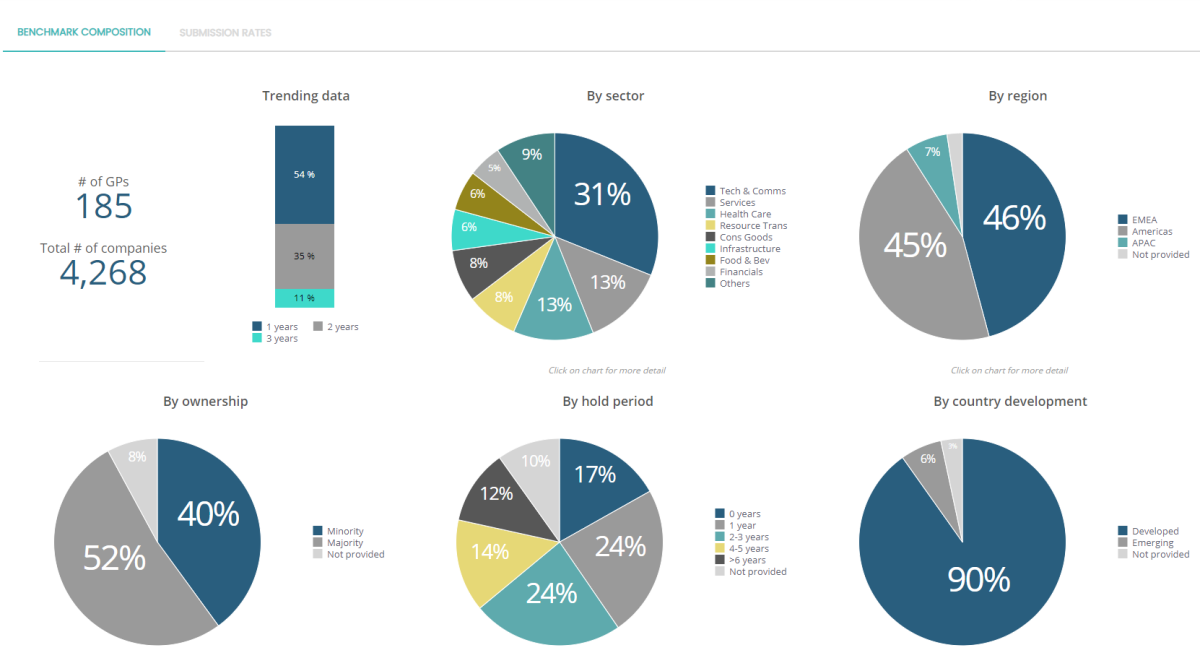

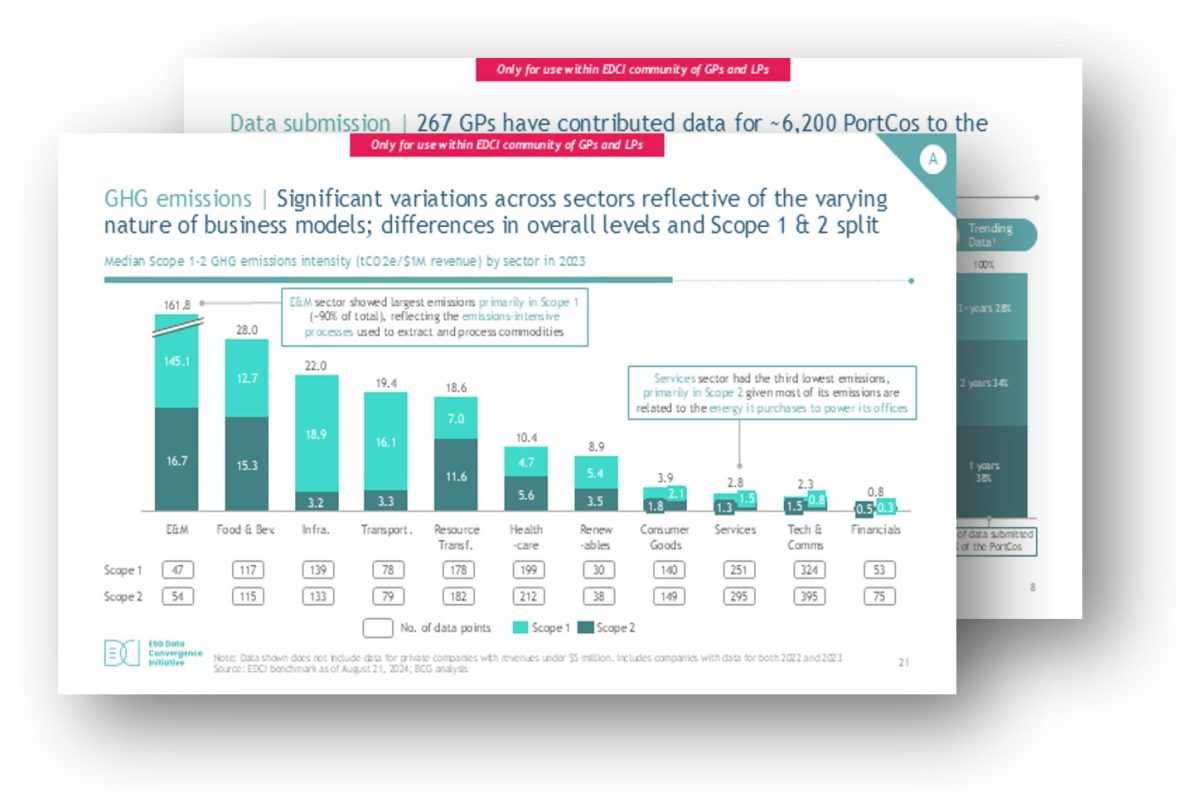

Gain clear insight into ESG performance as it compares to a standardized benchmark

03

Improved ESG Goals

Drive and track progress towards future targets with robust trending data and YoY analysis

04

Increased Accountability from GPs

Enable data-driven decision making throughout the investment process

05

Better Engagement with GPs

Request data directly from EDCI member GPs through user-friendly in-portal request management functionality

06

Analysis of Financial Correlation

Creates an additional analytical lens to understand ESG’s correlation to financial performance, unlocking insights and value-creation opportunities

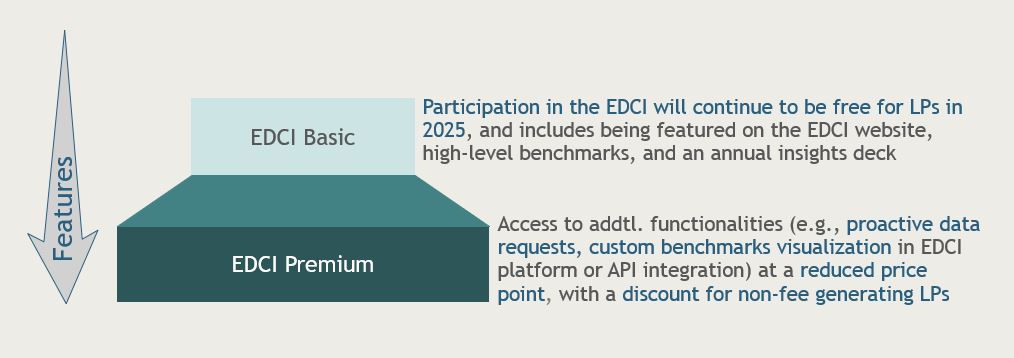

EDCI LP membership tiers for the 2025 Benchmark Year

LP Membership Features & Functionalities | EDCI Basic

LP Membership Features & Functionalities | EDCI Premium

What does it mean for Limited Partners to be part of this initiative?

To participate, LPs agree to:

- Where LP has relevant/ overlapping ESG data requests to GPs, align definitions with the EDCI’s definitions

- Be publicly associated with the initiative

- Voluntary: serve on working groups or self-nominate to join the Steering Committee